Supporting investment in the New Zealand Bioeconomy

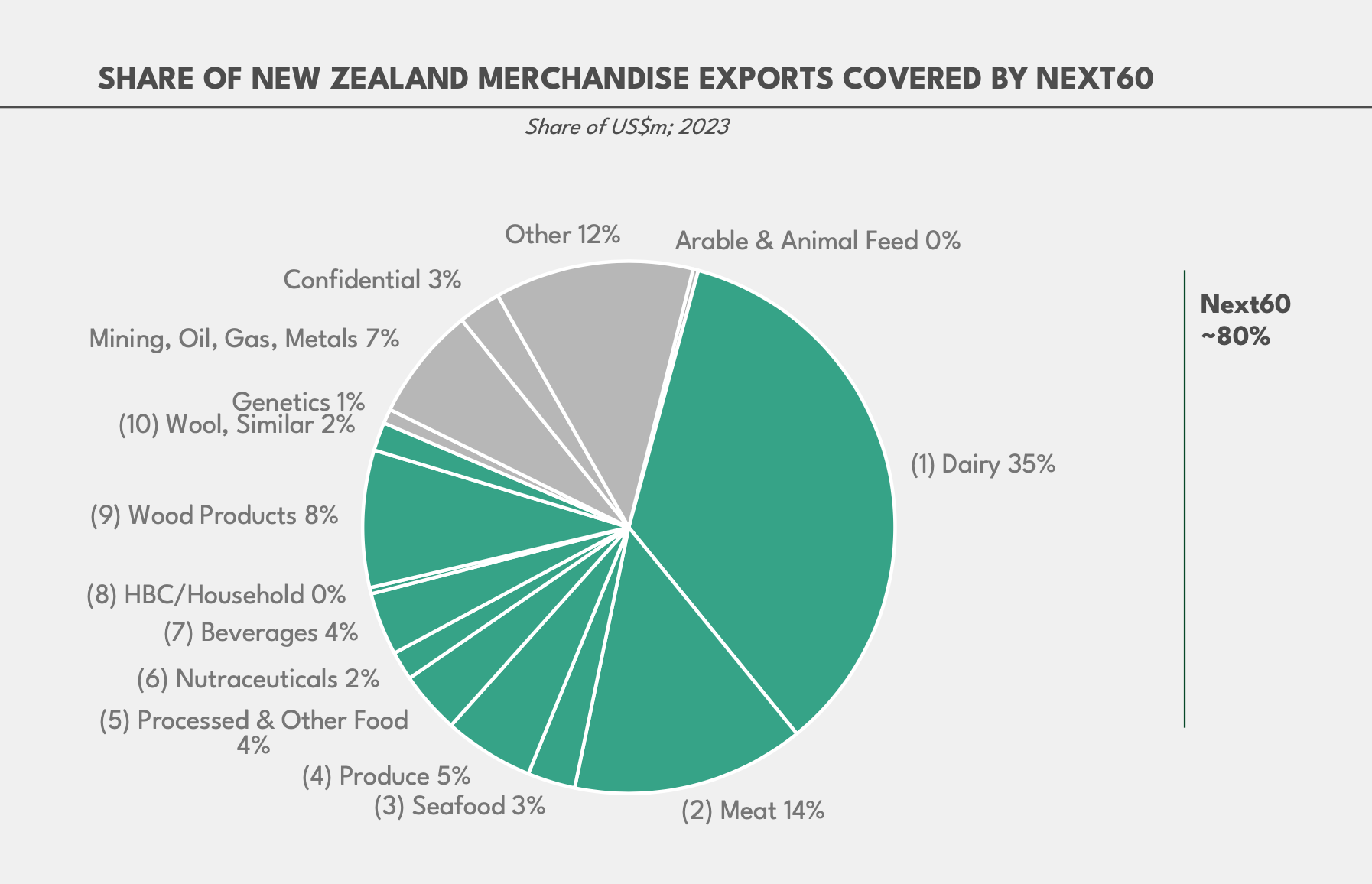

New Zealand’s biological economy, which can be described as the six “F’s” of Forestry, Farming, Fishing, Fibre, Food and Fast Moving Consumer Goods (FMCG), recently surpassed NZ$60b per year in exports. Next60 supports the investment needed to create the next sixty billion in export growth in the bioeconomy

next60: DAIRY 2024

Dairy 2024

The Investor’s Guide to the New Zealand Dairy Industry

Why Dairy? Large and growing global market (930m tonnes of milk worth ~$840b) with growing consumption.

Why New Zealand Dairy? NZ is the tenth largest milk producer and the global market leader in dairy trade, delivering US$14b worth of dairy to 120 markets (14% of global trade). NZ has a strong and growing sustainable comparative advantage.

Who is investing? Why? New Zealand dairy is an attractive destination for investors seeking to participate in this growth. Seven of the top ten global dairy companies have operations in New Zealand. The dairy processing industry has investments from five private equity firms, fourteen global multinationals, and seven state-owned enterprises.

How is the industry structured? There is a complex, multi-stage dairy product supply chain in New Zealand. ~600-700 firms are spread across the chain. New Zealand has sixteen major milk-to-ingredient processors, ~100 consumer dairy firms, a large, diverse, growing group of firms producing a wide range of dairy-centric processed foods (e.g. ice cream, infant formula, sports nutrition), plus a large and growing range of nutraceutical firms, many of whom produce a range of dairy-derived products.

What is driving milk supply? The supply of milk in New Zealand is driven by the interplay between the milk price paid to the farmer and their cost of production. Change is occurring with farms consolidating into fewer and larger operations. Dairy directly uses 6% of land (incl. feed) and is achieving more milk per cow per year.

What exports are growing? Numerous growth sectors exist across dairy exports. Fluid milk, infant formula, cheese, ice cream, protein, butter and powders are all showing significant growth.

Who are the Firms? - 200+ dairy firms are profiled, sourcing the “Coriolis BioSphere database”

next60: DRIVING INVESTMENT IN THE NEW ZEALAND BIOECONOMY

WHY? These ten sectors of the bioeconomy cover ~80% of New Zealand merchandise exports

THE PROJECT

Supporting the capital needed to double exports

next60 delivers sector due diligence to support the NZ$60b in investment needed to double bioeconomy exports. We will deliver analysis and insights across ten sectors.

Three groups need to raise capital and invest:

1) Existing large firms at scale

2) Greenfields investors with scale and skills

3) New and emerging firms

AUDIENCE

1) Core Industry

2) Investment Community

3) Key Stakeholders

4) Research Community

WHY

There is a gap in the New Zealand market for readily available investor-focused information beyond the farm gate. There are sources of on-farm data and sources on markets, but little beyond and little that looks at the total chain. Next60 fills the gap with independent, preliminary due diligence suitable for investment support.

THE SECTORS

First six cabs off the rank

CASE STUDY 3: Food and Beverage Information Project (iFAB) - Supporting investment in the NZ F&B sectors and wider bioeconomy (2011-2021)

Stream 1:

Investor’s Guides and Sector Reports

A ten year project profiling the NZ F&B sectors. The Investor’s Guides and Sector reports provide comprehensive and data-driven reports on the New Zealand food and beverage sectors. Sectors include Dairy, Meat, Seafood, Processed Foods, Produce and Beverages.

The reports describe market trends, export activity, identify investment opportunities and activity and profile the key businesses across each sector.

Over the period, the F&B sector created 900 new firms and 32,000 new jobs, grown F&B manufacturing industry by $16b and boosted exports by $14 billion (to $41 billion in 2020). This is why we care. F&B is important to New Zealand

Stream 2:

Emerging Growth Opportunities (EGO) and Special Topics

Which F&B sectors are emerging? Which sector will be the next wine industry? The EGO series assesses hundreds of F&B growth categories with deep dives into ten subtopics, including honey, pet food, and alcoholic beverages.

As examples from 2014 to 2020 retail pet food exports grew 17% (CAGR) adding $176m. Fresh Fruit exports grew to $3.9b adding $2.1b from 2013 to 2020 a 9% CAGR.

To grow, sectors and firms need to attract investment. Investment comes from existing local companies, overseas firms, the government or iwi groups. The iFAB reports allow firms and sectors to be seen.