CASE STUDY #3

Food and Beverage Information Project (iFAB)

Stream 1: Sector Reports and Investor Guides

Supporting investment and growth in NZ’s Food and Beverage sectors. A 10 year (2011-2021), all-of-government project.

Client

Problem

In 2006, the NZ Food & Beverage Taskforce identified a critical gap: data and information on the sector was fragmented, inconsistent, and insufficient to support confident investment or policy development.

Solution

Coriolis proposed a long-term programme to develop a comprehensive, consistent, and public set of data-driven reports covering the entire NZ food and beverage sector.

These reports would analyse sector dynamics, market trends, investment activity, and key players—making the F&B sector visible and investable. They are freely available for use by investors, industry participants, government and researchers.

What we did

Over the course of 10 years, Coriolis produced:

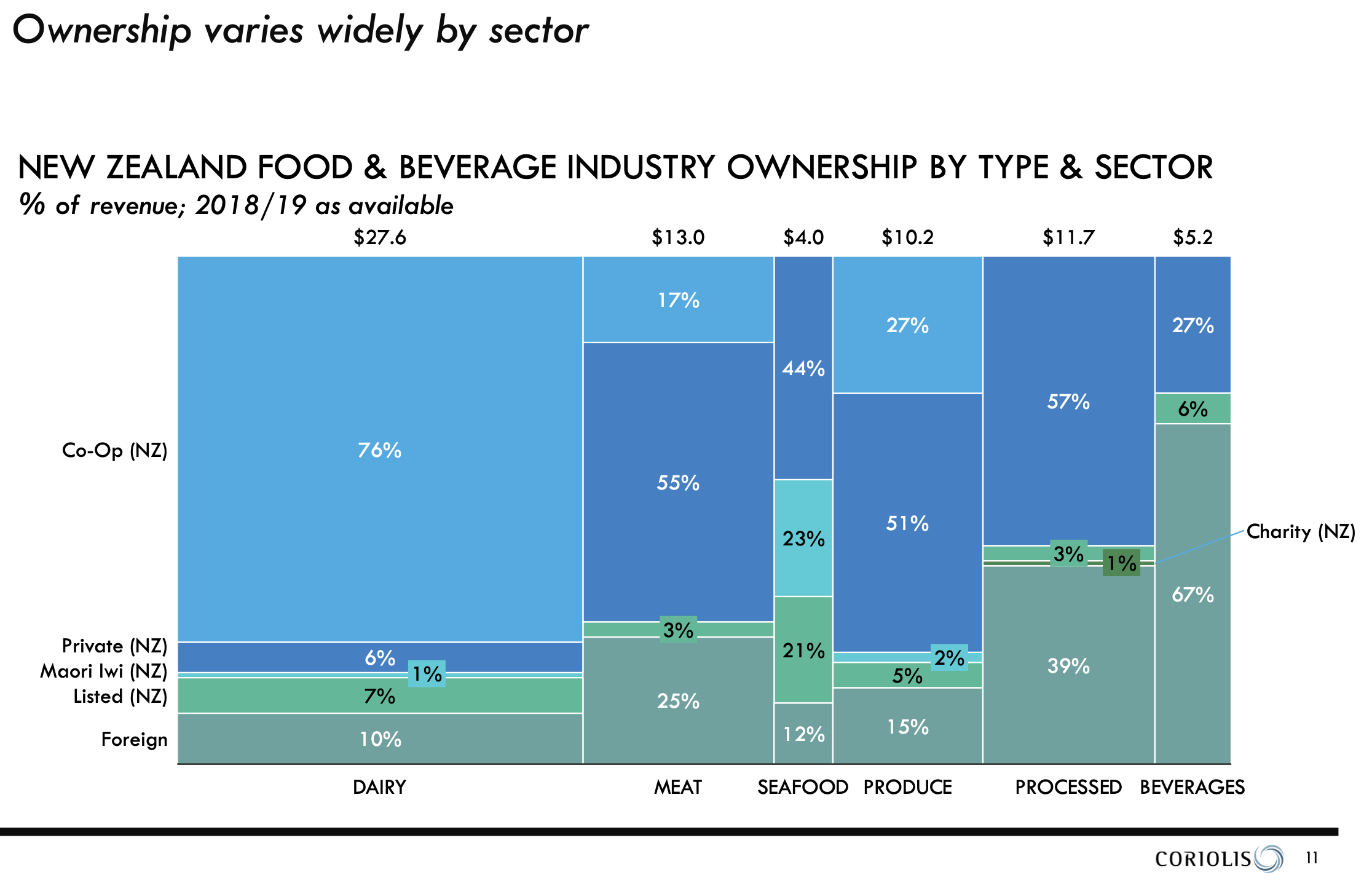

22 in-depth Sector Reports, covering Dairy, Meat, Produce, Seafood, Processed Foods, and Beverages

7 Investor’s Guides and Overview Reports, providing narrative-driven summaries to promote international investment

Deep dives into high-interest sub-sectors (e.g. Fresh Fruit, Nutraceuticals, Seafood)

Each report included:

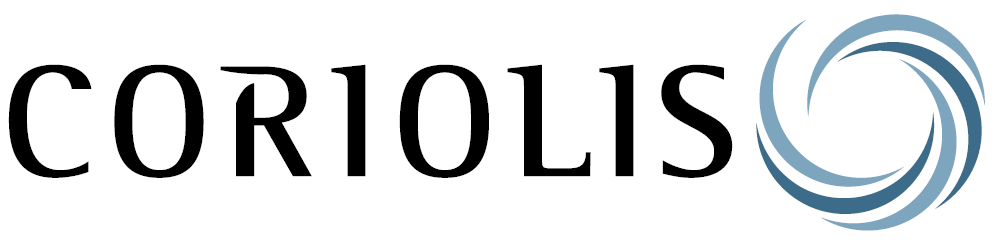

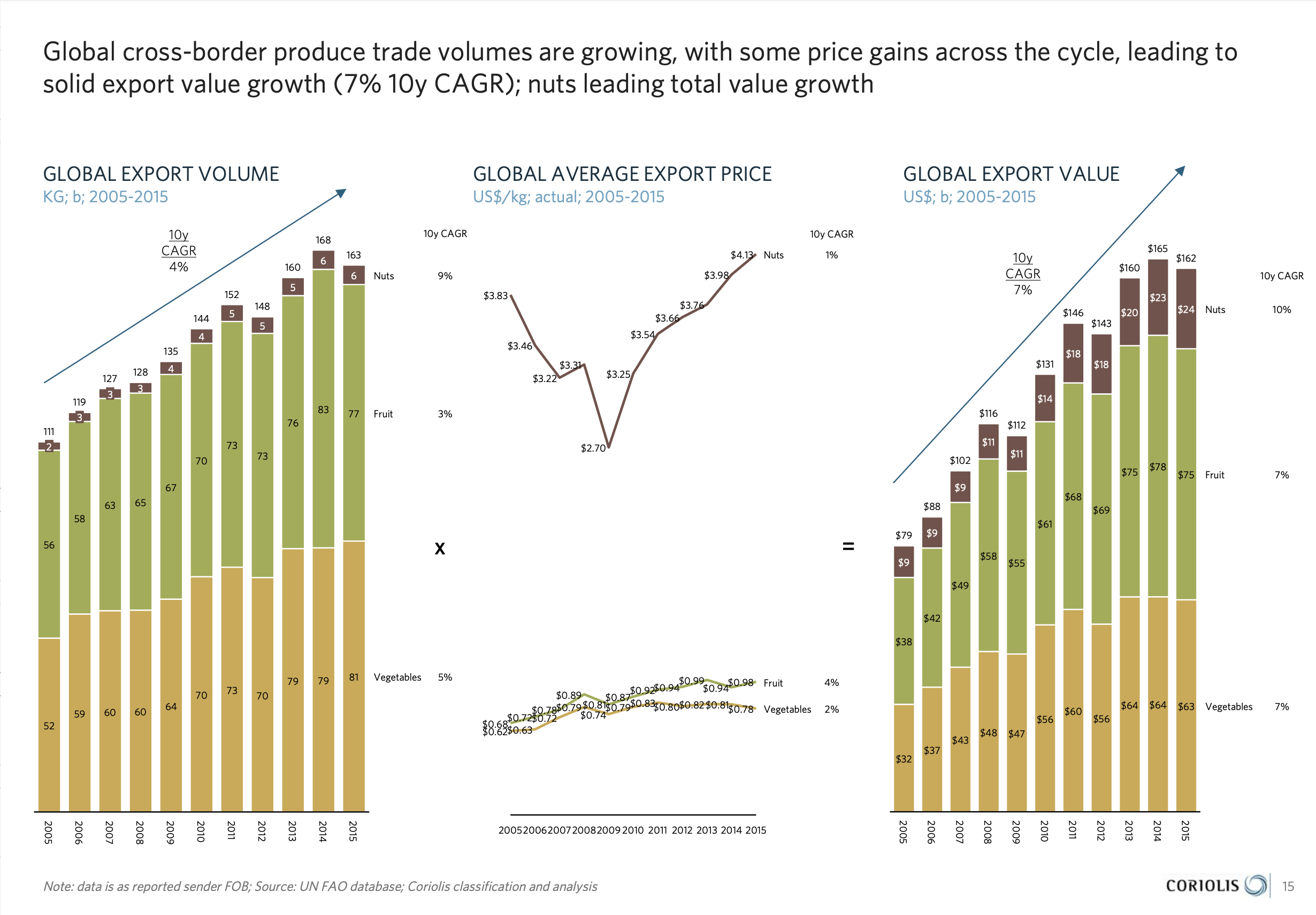

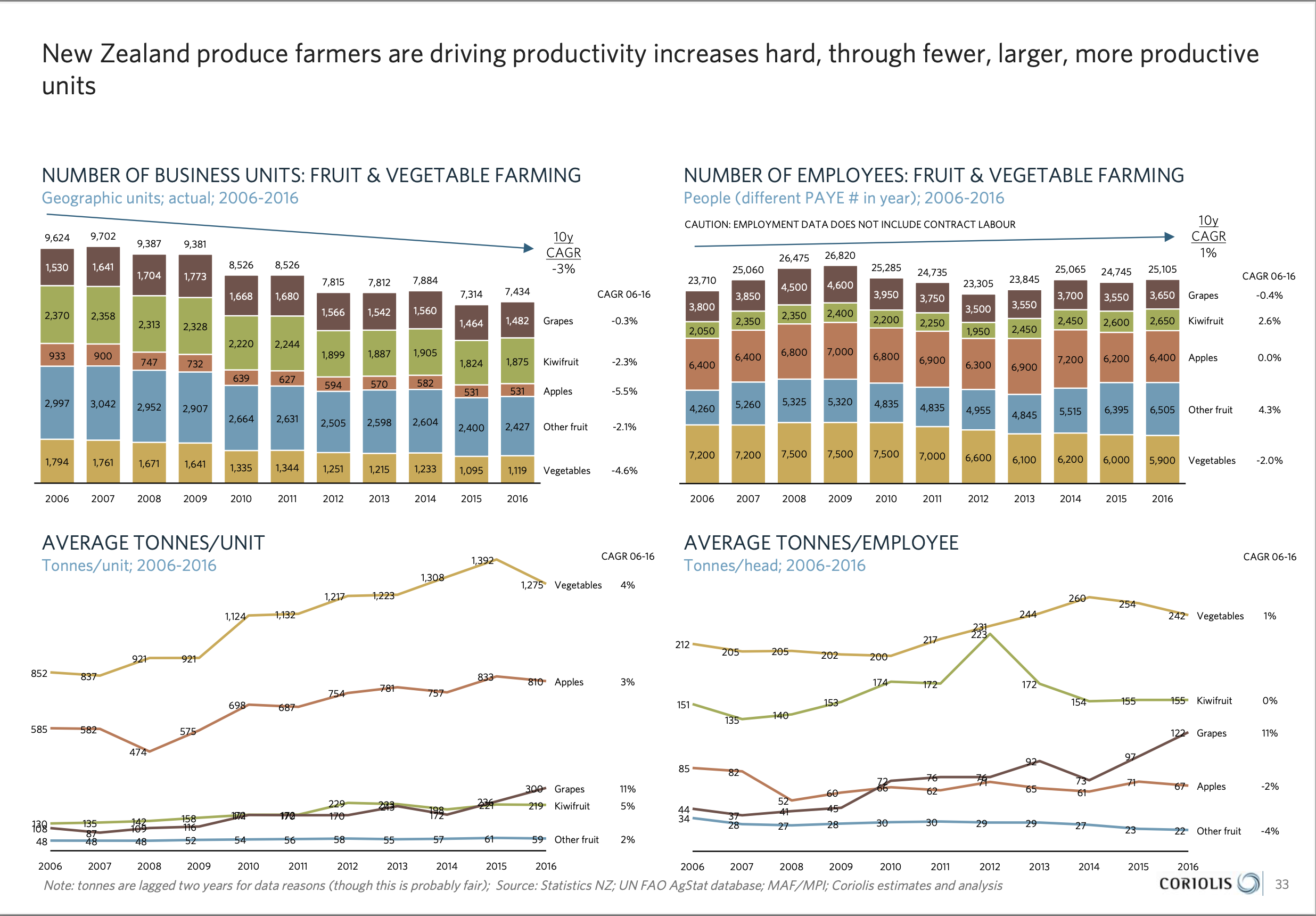

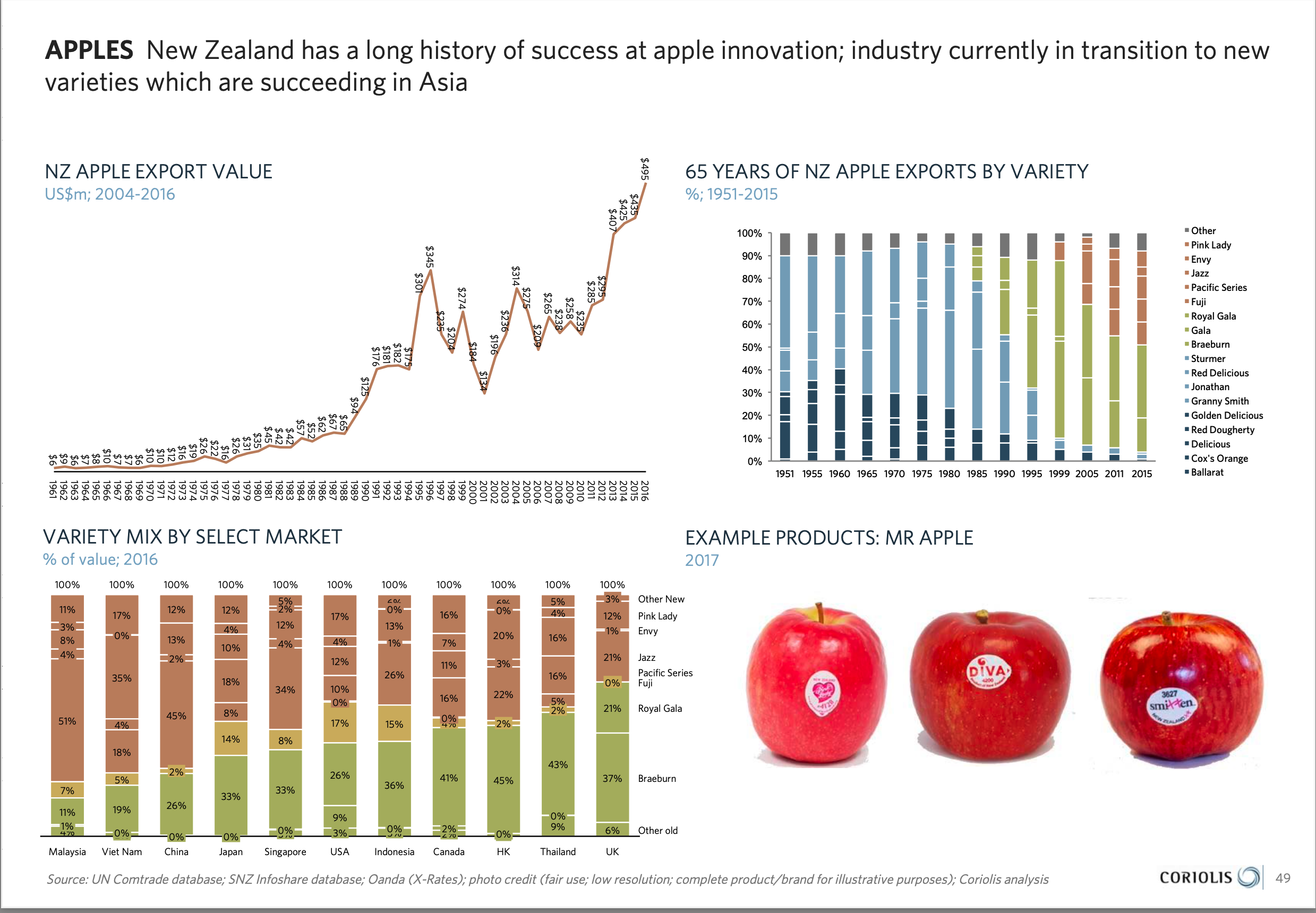

Export and production data

Market and segment analysis

Global comparisons

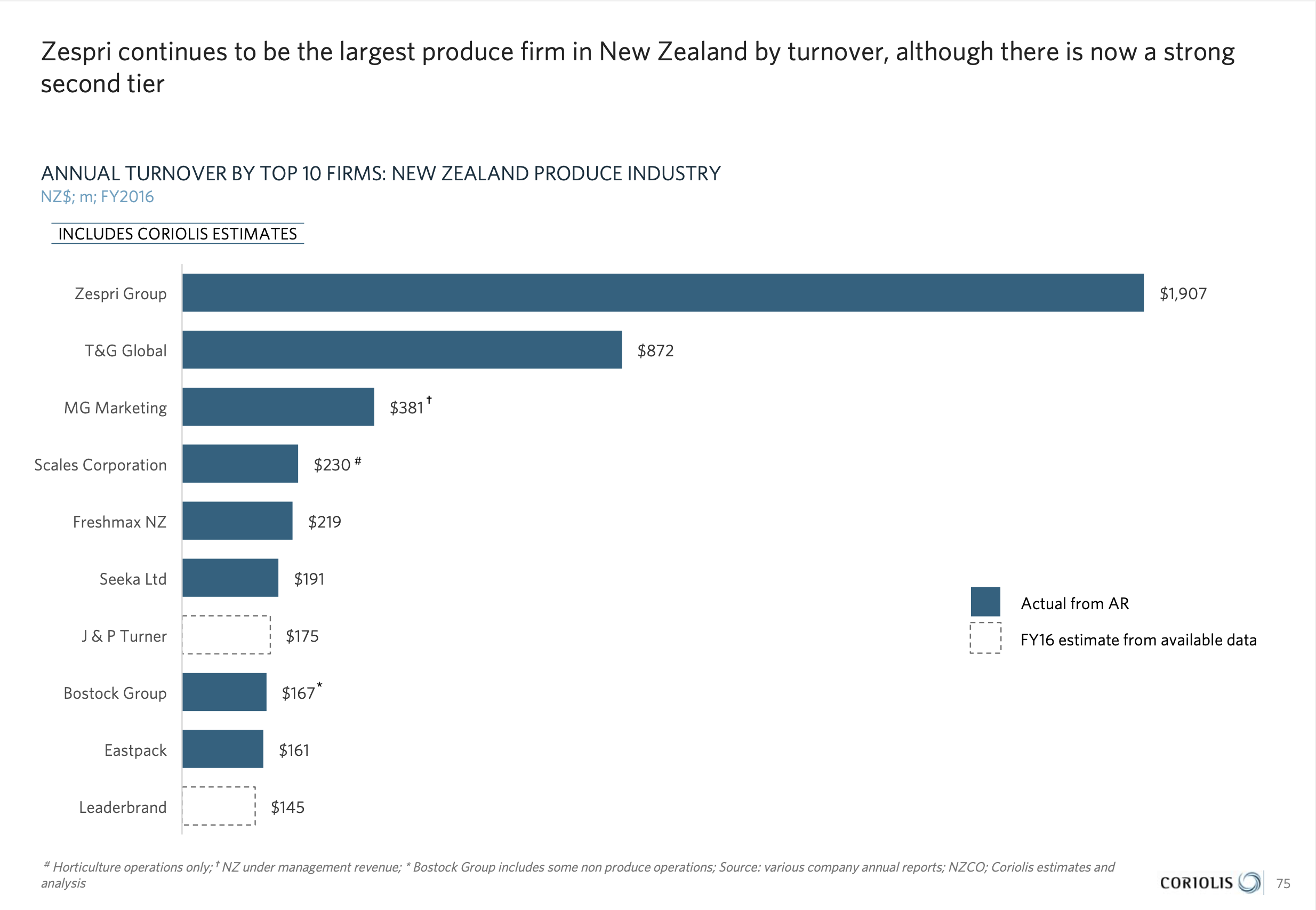

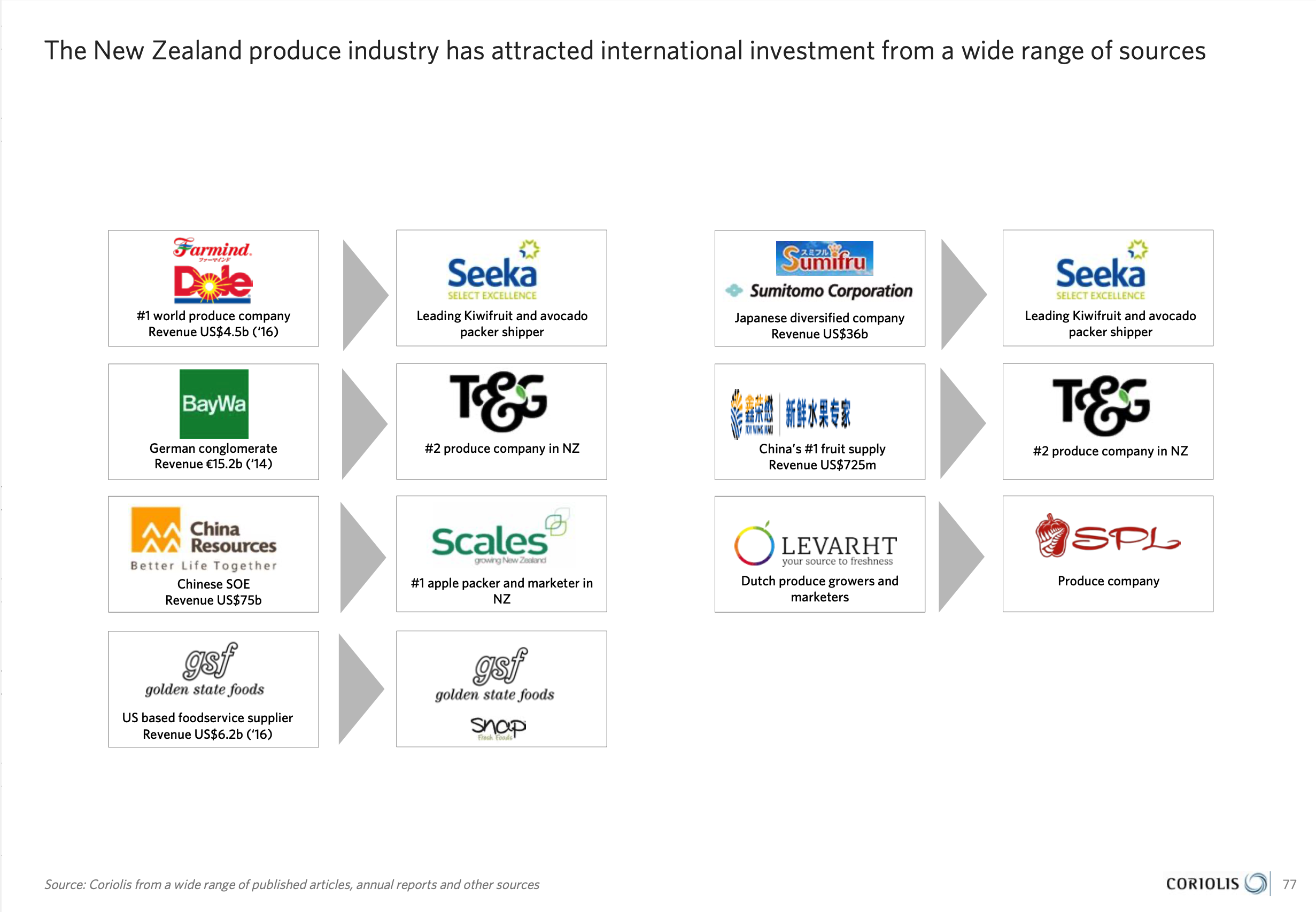

Investment activity and acquisition profiles

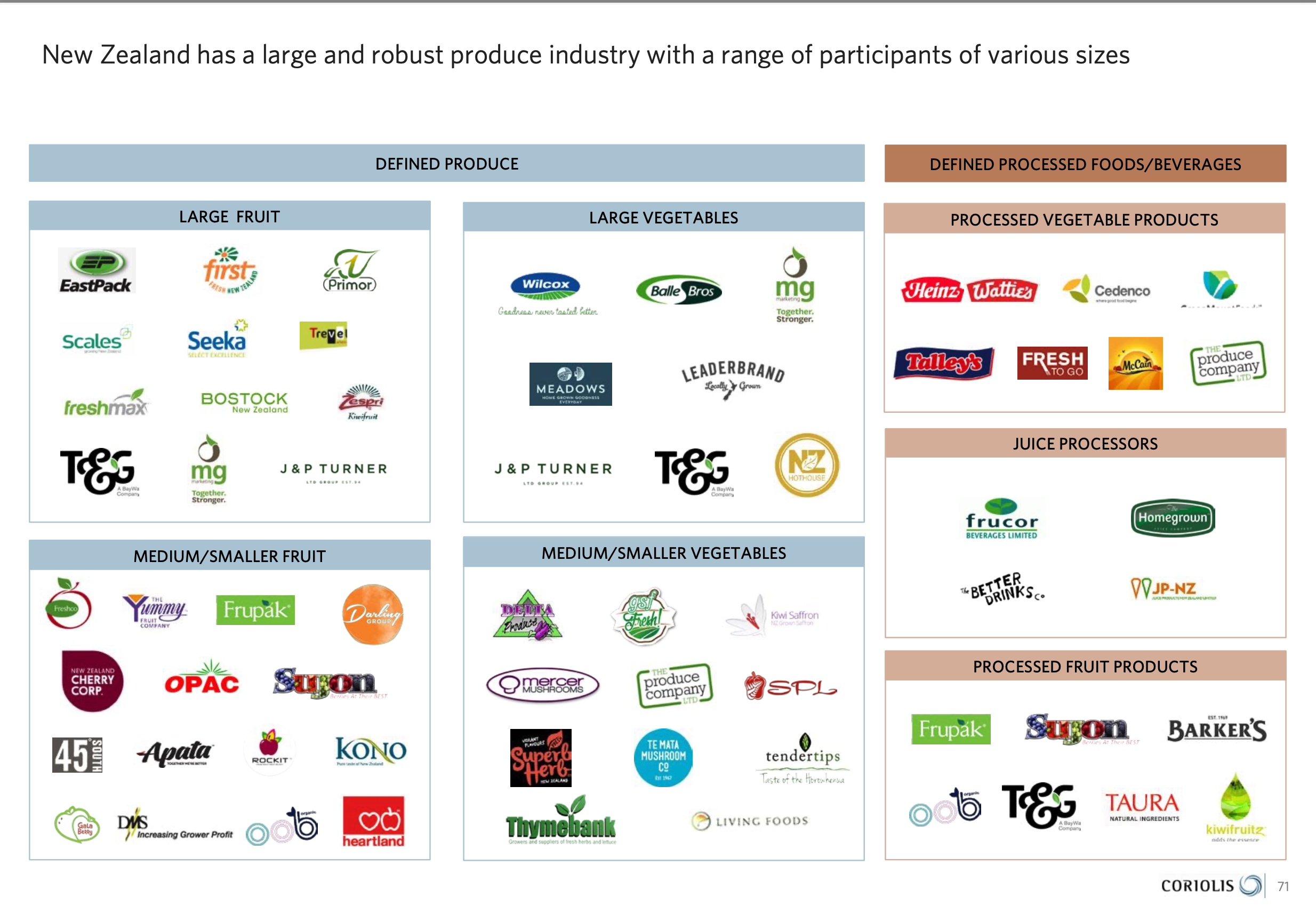

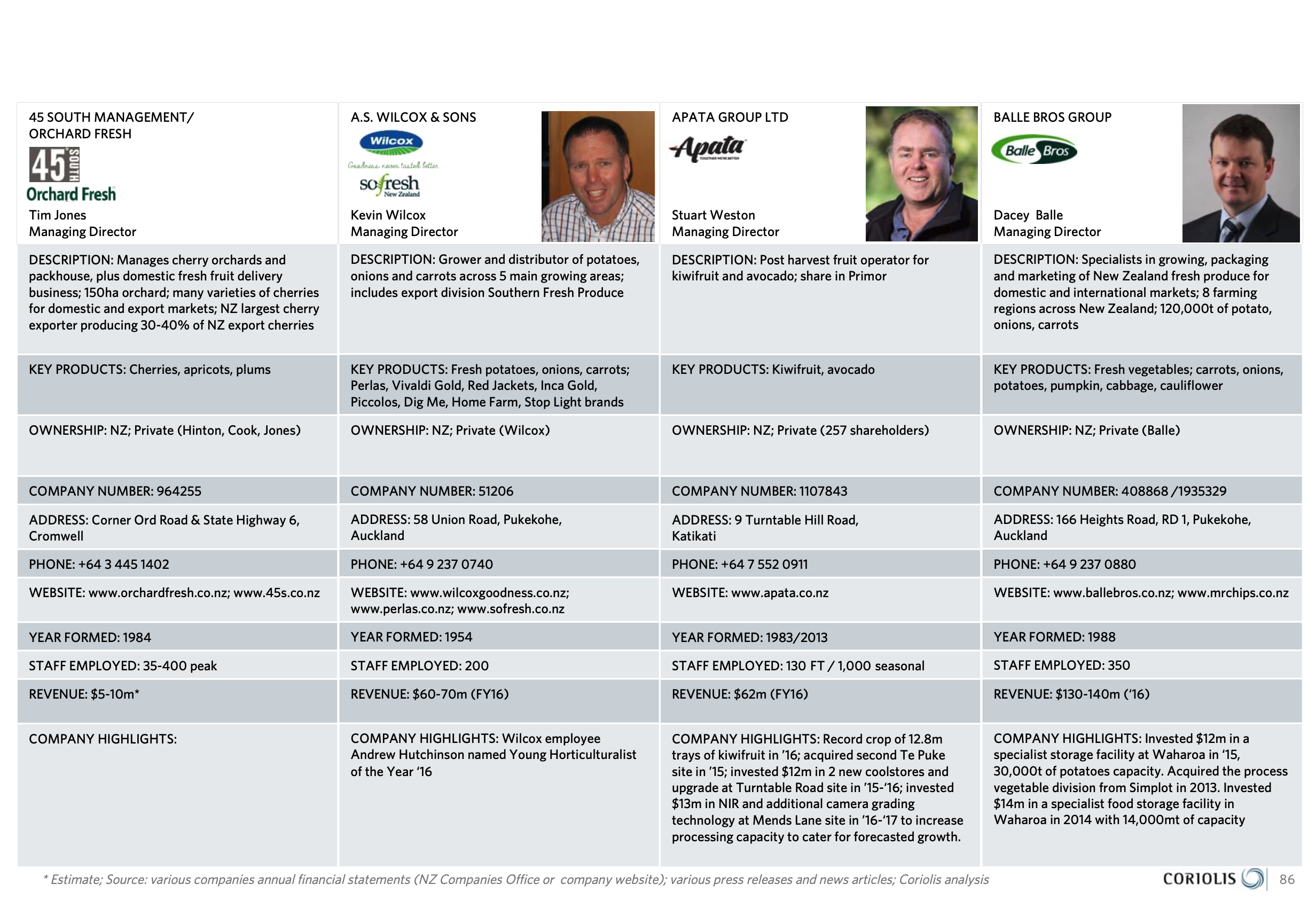

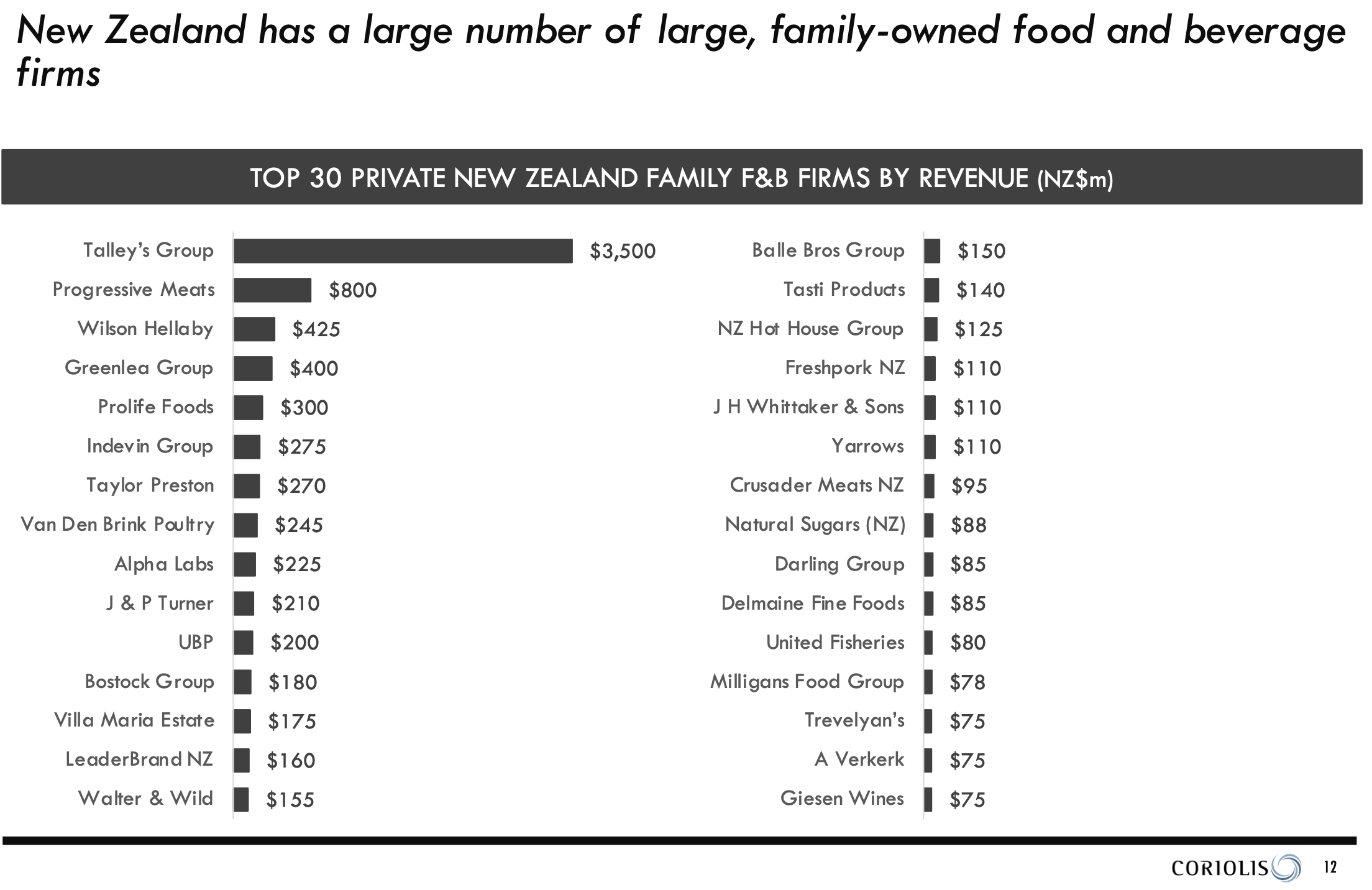

Key company profiles and value chain maps

Investors Guides

Sector Reports

Output

The output from Stream 1 was:

Twenty two sector reports (including sector depths)

Seven Investor Guides and Overview Reports

These reports were distributed to firms and potential investors across the sector, including those through international offices.

Outcomes

Results

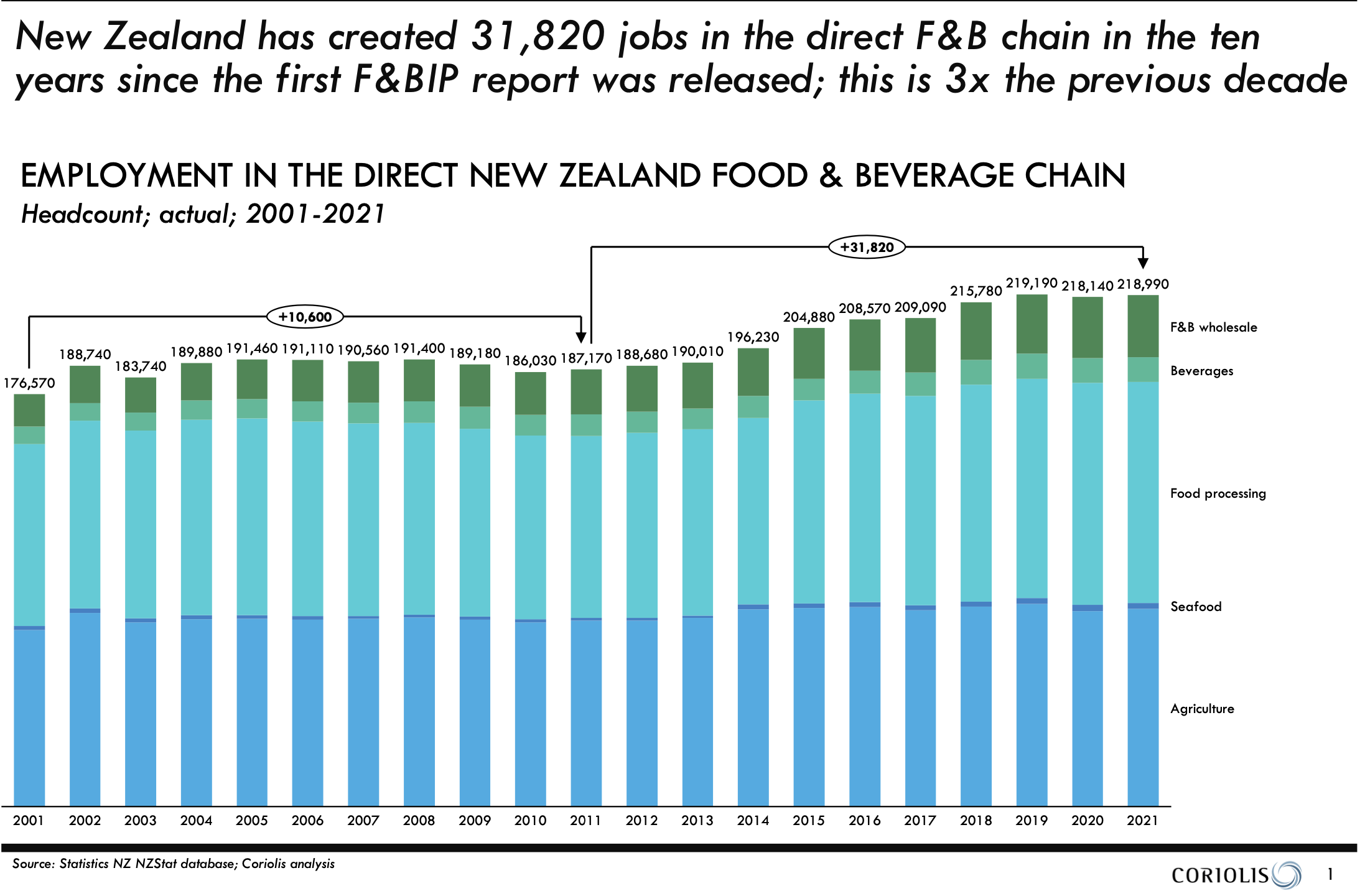

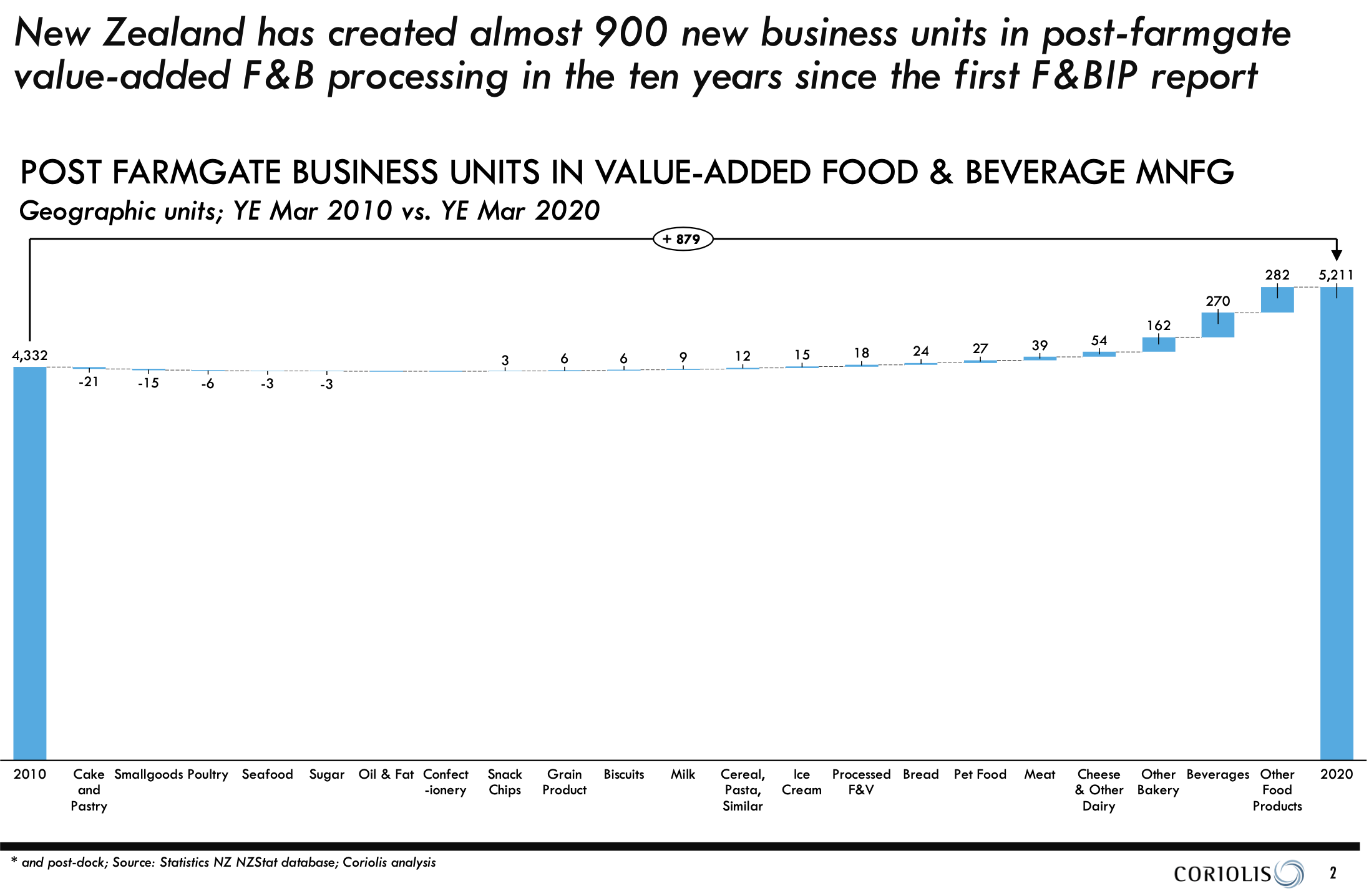

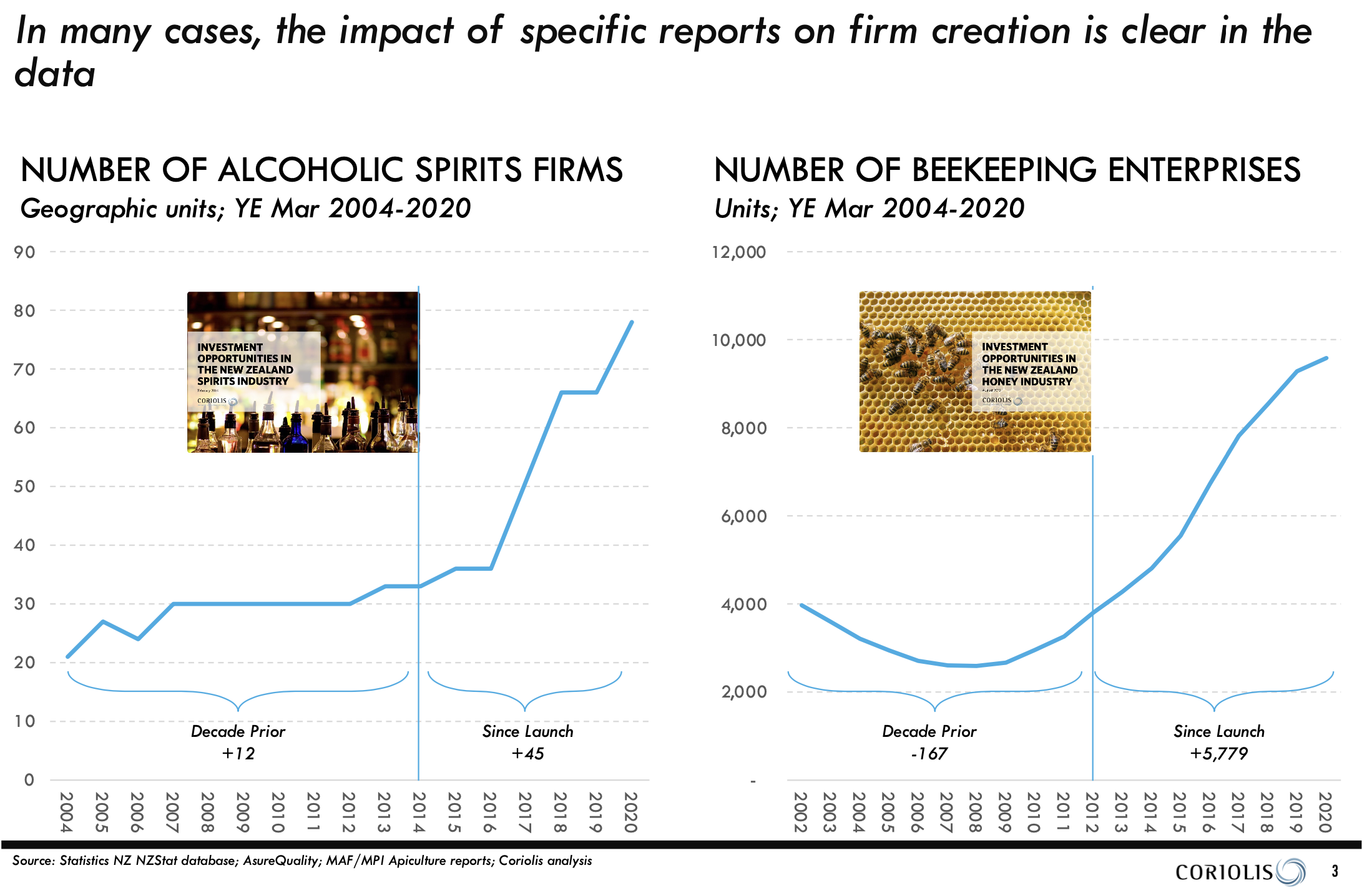

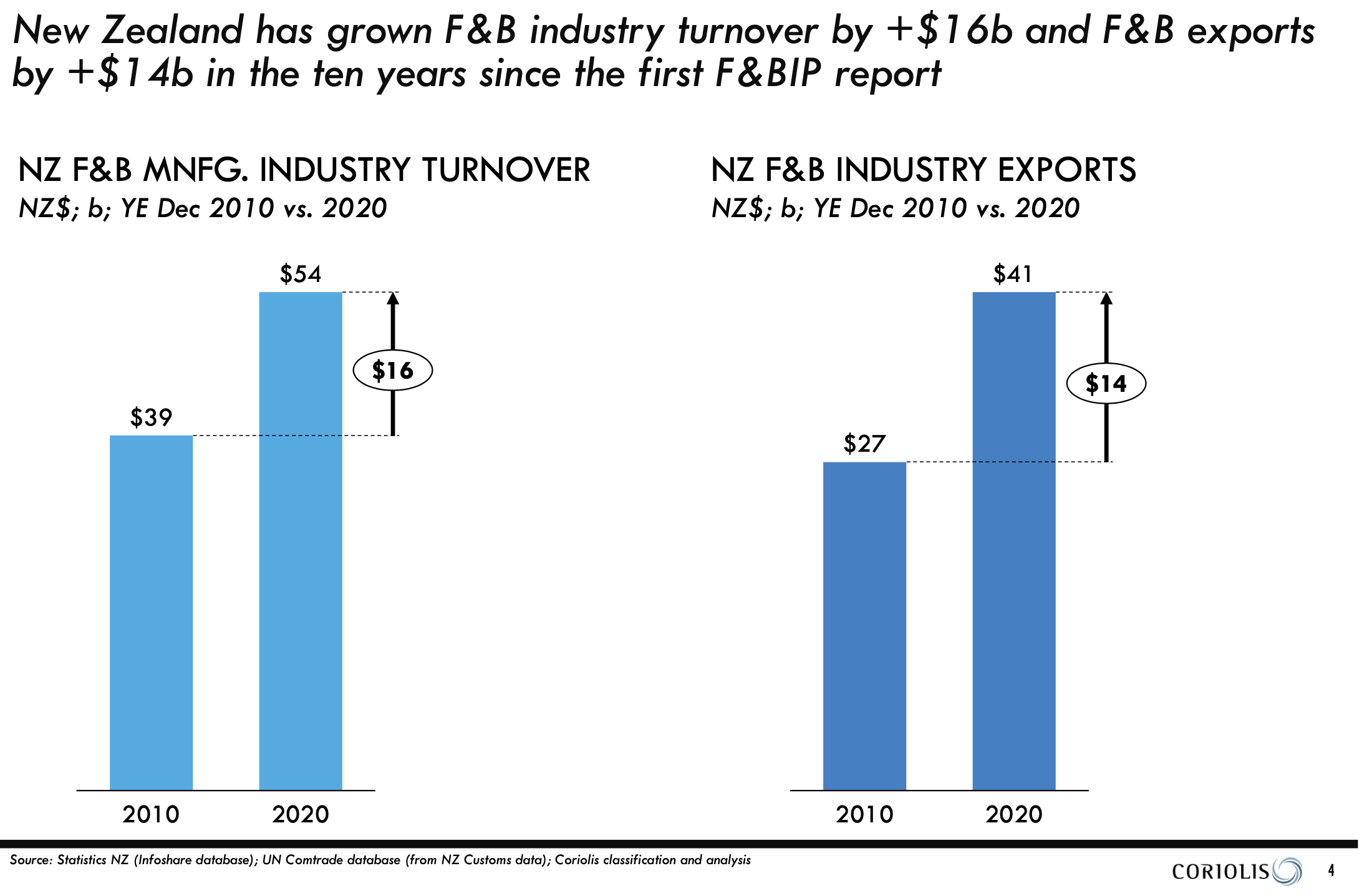

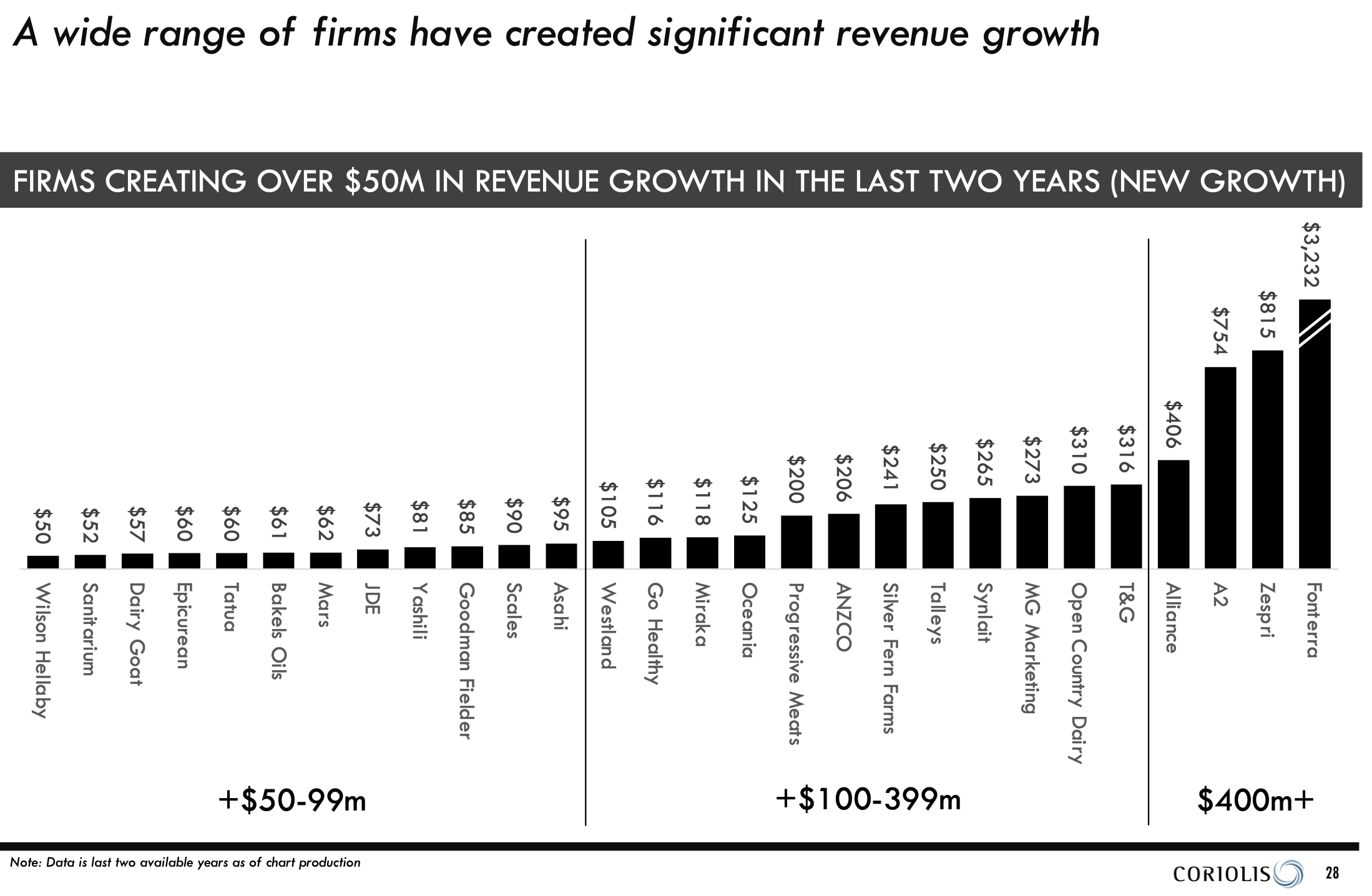

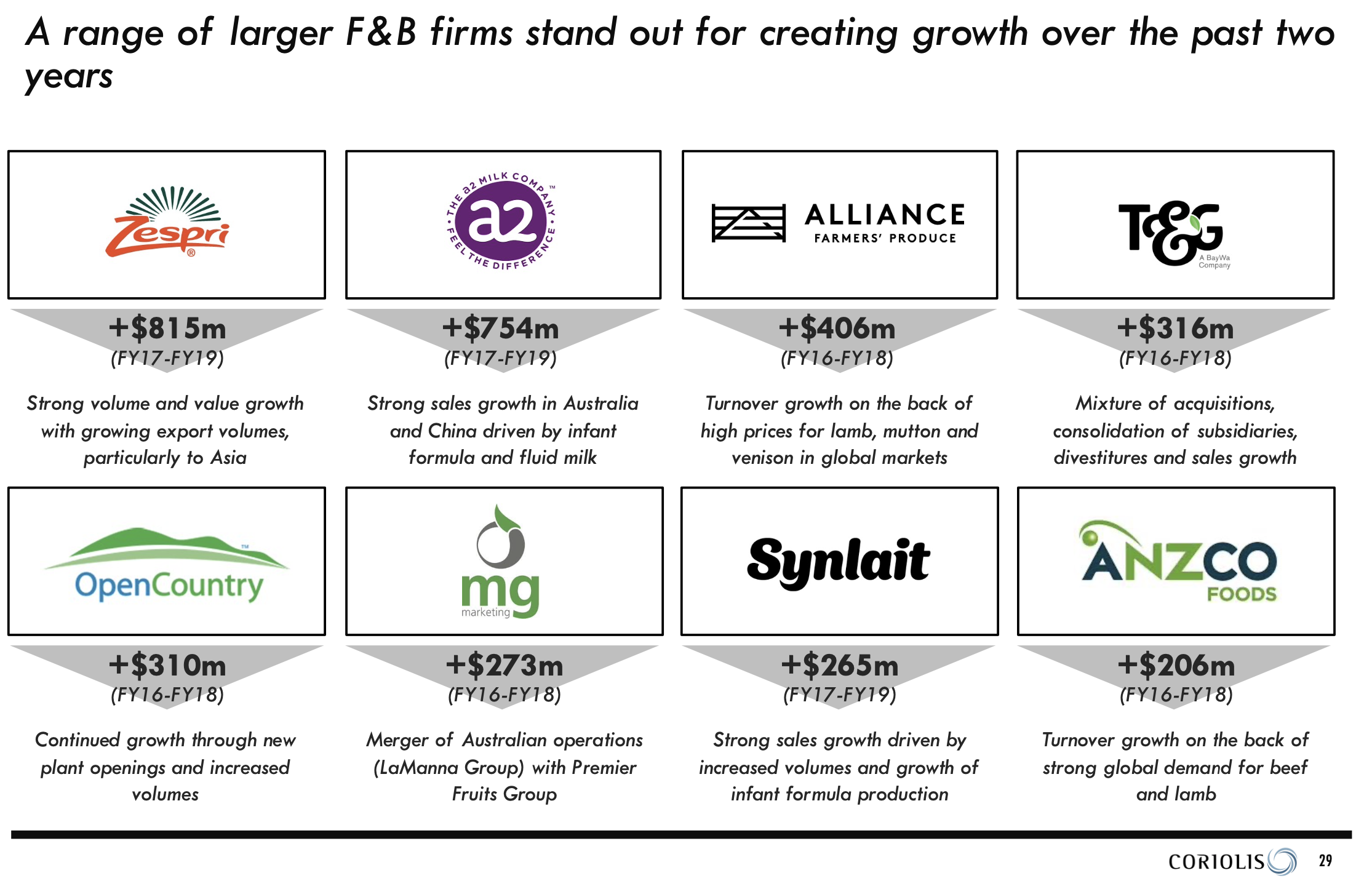

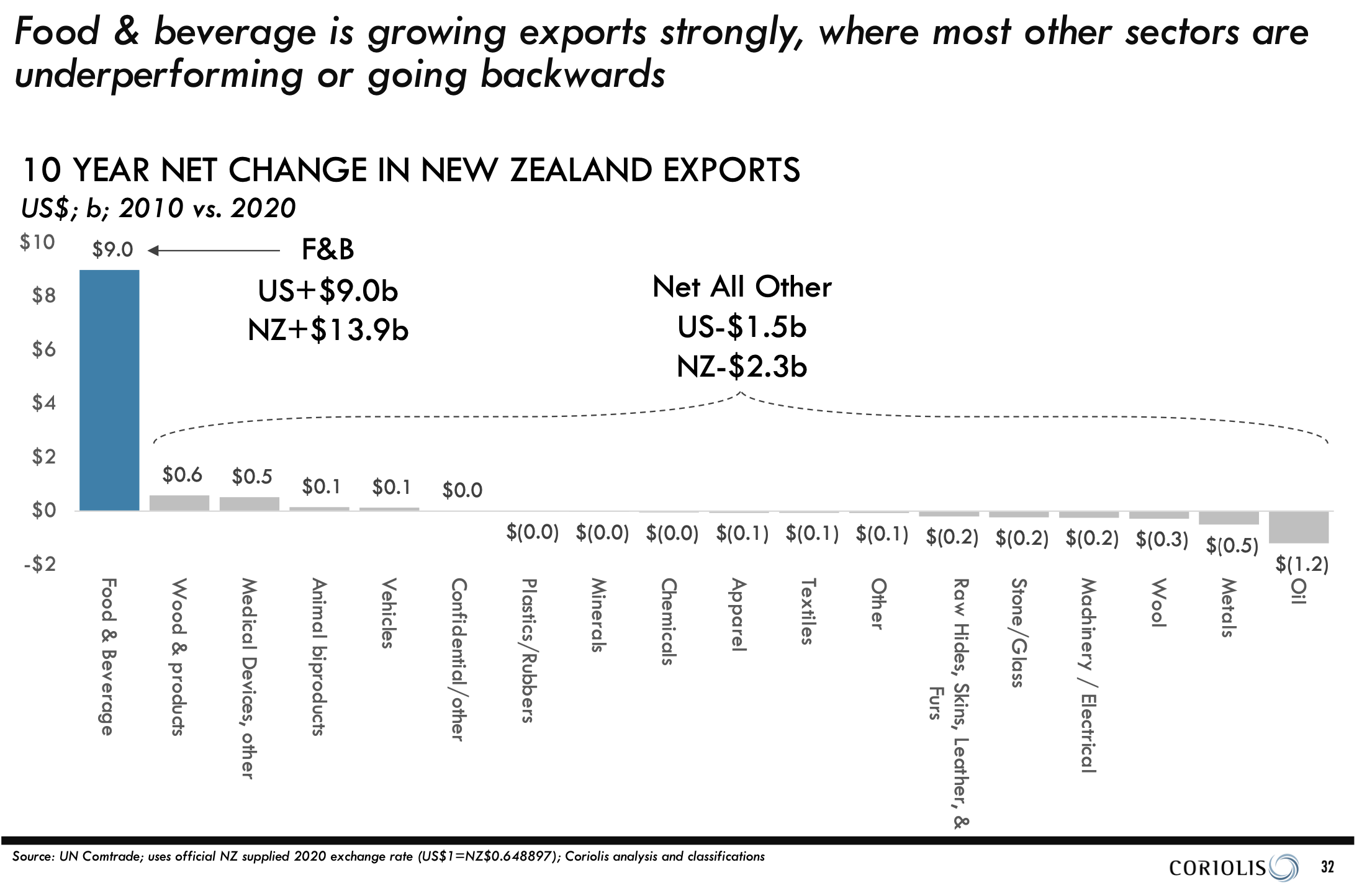

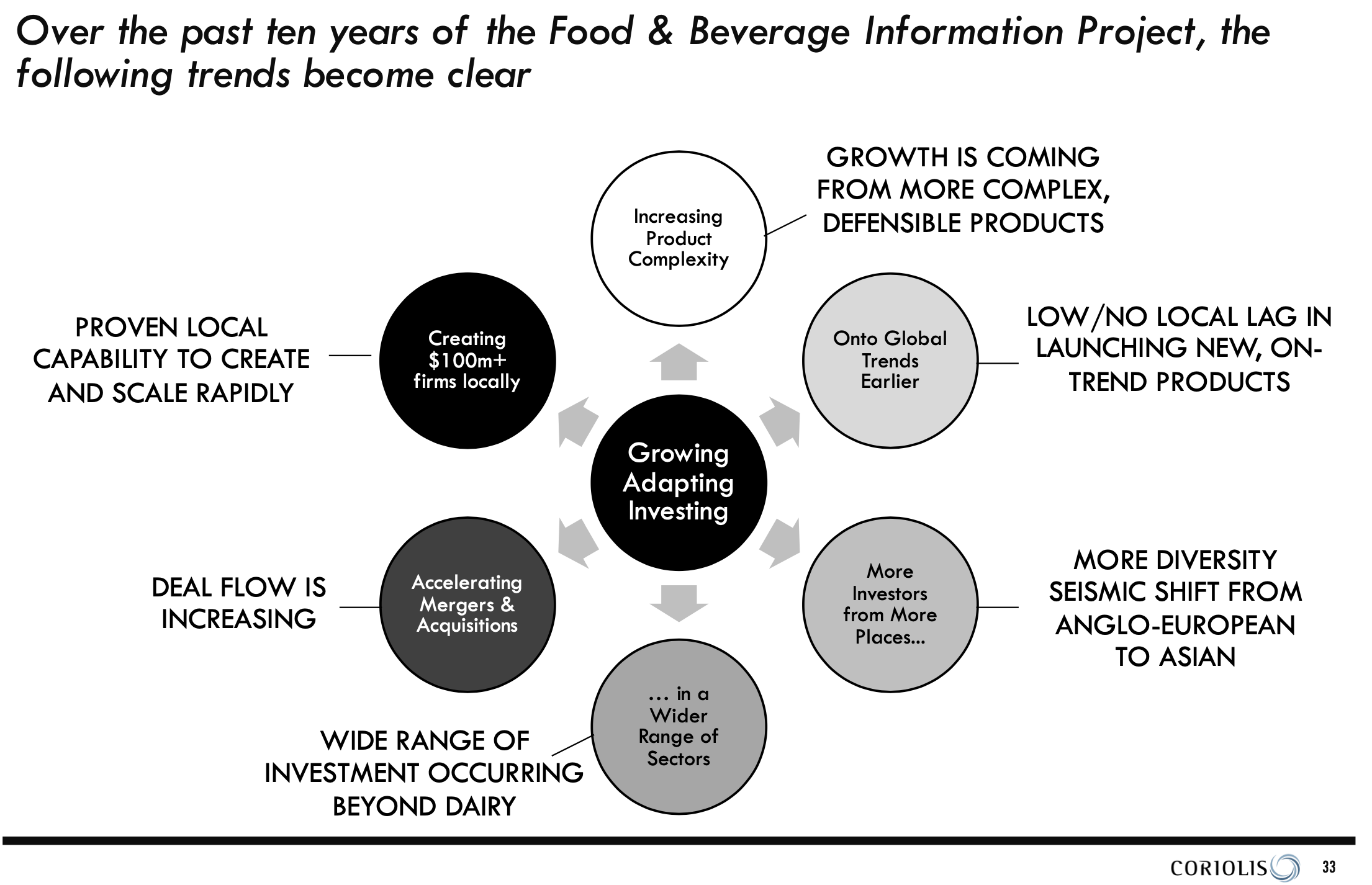

In the 11 years of the Project's existence, the New Zealand food and beverage industry was the major engine of export growth for New Zealand. Over this period, the industry created almost 900 net new firms, generated almost 32,000 net new jobs, increased food and beverage manufacturing industry turnover by NZ$16 billion (to $54 billion in 2020), and boosted exports by $14 billion (to $41 billion in 2020). To achieve this, it needed to attract at least NZ$14 billion in investment. The industry delivered results for New Zealanders. Over the same period (2010 to 2020), the net value of all other merchandise trade exports shrank by $2 billion. Food and beverage was the only major sector that "kept the economic ship afloat."

Drives Investment

The project drives investment by mitigating sectoral risk, providing in-depth insights into the growing, innovative, and competent New Zealand food and beverage sector. The reports showcase the country's strong comparative advantages, positioning it as a serious contender for investment. This allows investors to focus on specific businesses, reducing overall risk and uncertainty. The comprehensive reports, notably the "Investor's Guides,” reinforce New Zealand's appeal, attracting diverse investors and dispelling outdated perceptions, ultimately making a compelling case for investment in the thriving industry.

Why iFAB Matters

The iFAB project has been one of New Zealand’s most impactful sector-level economic development initiatives. It demonstrated how credible, strategic, and openly available information can:

Attract investment

Drive sector growth

Inform public policy

And build long-term economic resilience

Food and beverage is not just important to New Zealand—it’s essential. iFAB helped ensure it stayed globally competitive and locally prosperous.

“A feeling of serenity comes over me, when I open one of your reports.”

“In a small way, the research helped keep interest rates down. It resulted in more confidence and less risky lending.”